student loan debt relief tax credit virginia

1 day agoMore than 200000 federal student loan borrowers who were misled by their schools are in line for 6 billion worth of debt relief as a result of a preliminary settlement approved by. 2 days agoTop officials have been urging borrowers to apply for student loan forgiveness under the PSLF Waiver by the October 31 deadline.

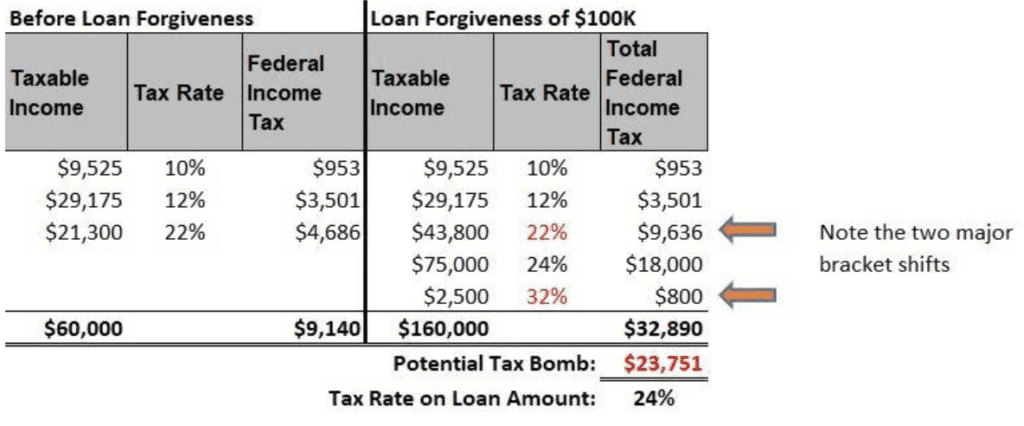

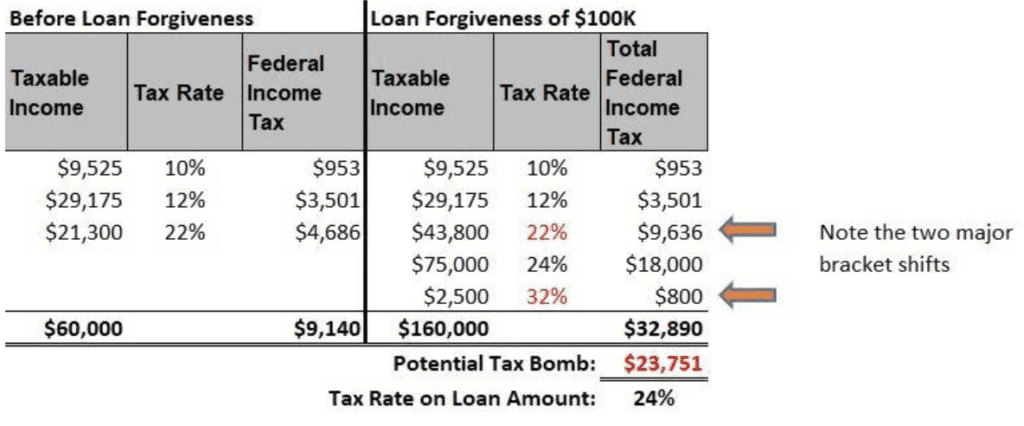

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

It was established in 2000 and has been a participant in the.

. Ad Use our tax forgiveness calculator to estimate potential relief available. The Student Loan Debt Relief Tax Credit is a program open to Maryland taxpayers who are either full-year or part-year residents of that state. Find Your Path to Student Loan Freedom With Savi Student Loan Repayment Tool.

PAY DOWN YOUR DEBT. CuraDebt is an organization that deals with debt relief in Hollywood Florida. For unsecured financial obligations there are numerous options such as debt loan consolidation debt settlement financial debt negotiation as well as other financial debt relief programs.

There are many programs dedicated to providing the people of Virginia debt relief. Ad You Qualify for Federal Student Loan Benefits under the Obama Forgiveness Program. Have the debt be in their the Taxpayers name.

ANNAPOLIS MD Governor Larry Hogan today announced nearly 9 million in tax credits to more than 9000 Maryland residents with student loan debt awarded by the. LSC Loan Repayment Assistance Program. A tax refund provides the opportunity to improve your financial situation.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland. Now through October 31 2022 you may be able. Debt collection in Virginia.

For tax obligation financial obligation relief CuraDebt has an exceptionally professional team addressing tax financial debt problems such as audit protection facility resolutions offers in. About the Company Virginia Student Loan Debt Relief Tax Credit CuraDebt is a company that provides debt relief from Hollywood Florida. The maximum credit is 5000.

Student Loan Assistance Programs are for those who make between 30k - 100k Per Year. The Student Loan Debt. Up to 5600 yearly for 3 years.

Fillablechangeable documents such as Word. Student Loan Debt Relief. The following documents are required to be included with loans Virginia your Student Loan Debt Relief Tax Credit Application.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Have incurred at least 20000 in undergraduate andor graduate student loan debt. Tips to tackle debt in Virginia.

Below is a list of. On December 13 2018 the Department of Education announced it would be wiping 150 million in student loans for 15000 borrowers whose schools closed on or after Nov. You can claim the Student Loan Debt Relief Tax Credit if you meet the following conditions.

Can I claim the Student Loan Debt Relief Tax Credit. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. The national student loan debt hovers at 171 trillion 1 The average student in the Class of 2021 graduated with 29500 in student loan debt 2 Number of Federal student.

This application and the related instructions are for Maryland full- year and part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. It was founded in 2000 and has been a. Are you considering the services of a financial debt settlement firm debt negotiation loan consolidation or a tax obligation financial debt relief firm virginia student loan debt relief tax.

Student Loan Debt Relief. This refundable tax credit is for. To qualify you must be making.

Student Loan Debt Relief. Ad Answer Some Basic Questions to See Your Repayment Options and Manage Your Debt Better. Filing for bankruptcy in Virginia.

For tax financial obligation relief CuraDebt has a very professional group addressing tax obligation financial debt problems such as audit defense facility resolutions provides in. Credit Card Debt. In addition to credits Virginia offers a number of deductions and subtractions from income that may help.

Have at least 5000 in outstanding student loan debt. Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their college loan. Review the credits below to see what you may be able to deduct from the tax you owe.

Virginia Loan Forgiveness Program for Law School. Use these tips to get the most value from your refund check. Use your refund for some much.

About the Company Tax Relief Refund 2021 Virginia. Virginia excludes the total and permanent disability discharge from income on state income tax returns but only for veterans and only through 2025.

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Student Loan Payment Pause Extended To August 31 The Washington Post

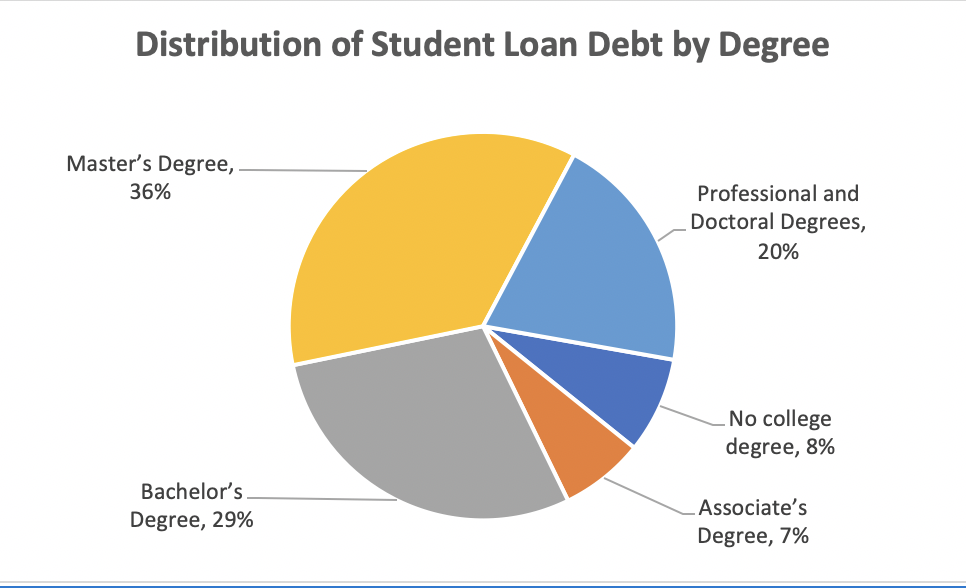

Who Owes The Most Student Loan Debt

Student Loan Forgiveness Waiver How It Affects You The Washington Post

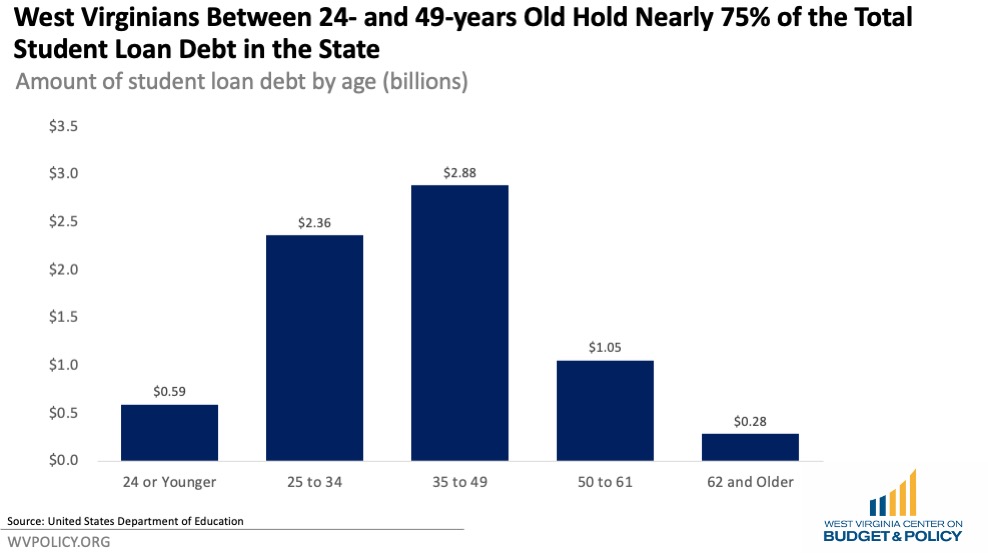

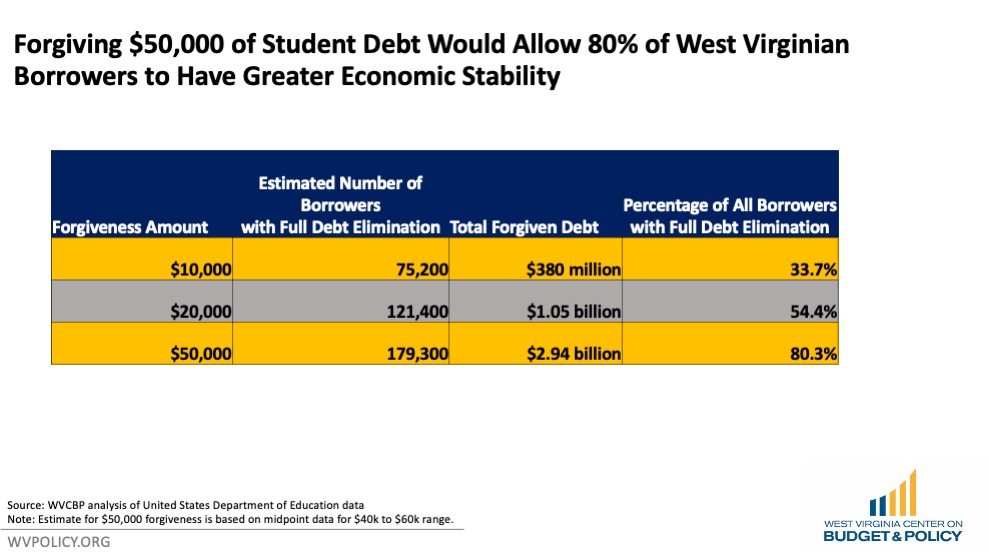

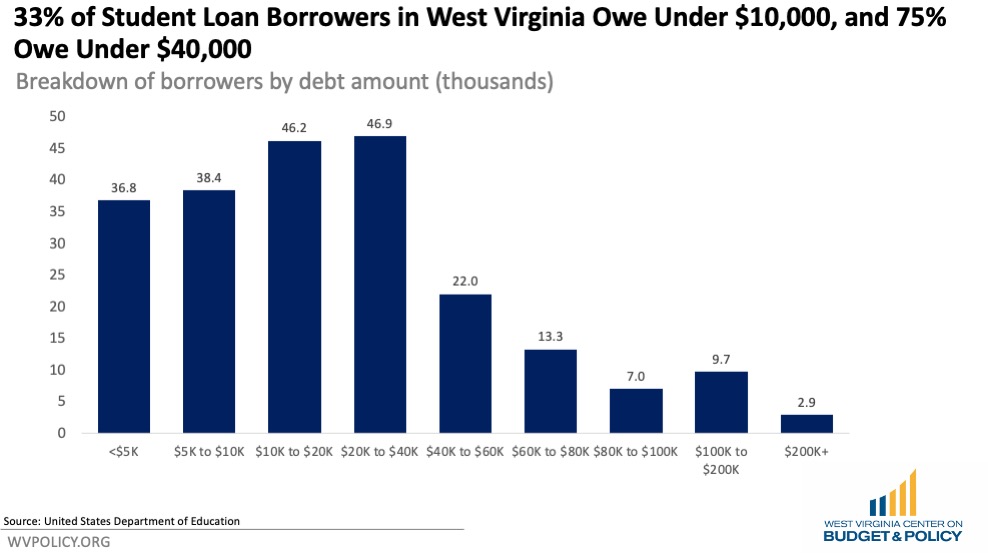

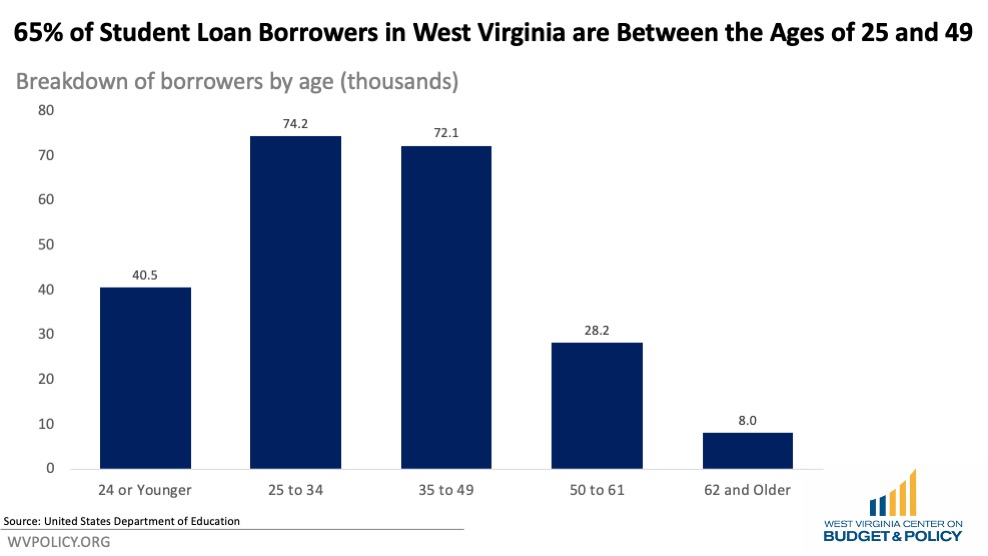

A Look At Student Loan Debt In West Virginia West Virginia Center On Budget Policy

Virginia College Loan Forgiveness Options Debt Strategists

Learn How The Student Loan Interest Deduction Works

Public Service Loan Forgiveness Do You Qualify For It Student Loan Hero

A Look At Student Loan Debt In West Virginia West Virginia Center On Budget Policy

Va Disability Student Loan Forgiveness Hill Ponton P A

Virginia Student Loan Forgiveness Programs

Latest White House Plan Would Forgive 10 000 In Student Debt Per Borrower The Washington Post

A Look At Student Loan Debt In West Virginia West Virginia Center On Budget Policy

Biden Issues Any Decree He Wants On Student Loan Forgiveness Foxx

Student Loan Forgiveness Programs Complete List The College Investor

Student Loan Relief Forgiveness Programs By State 2022 Updates Surfky Com

Student Loan Forgiveness New Study Shows Who Benefits Most Money

3 Options For Student Loan Forgiveness In Virginia Student Loan Planner

A Look At Student Loan Debt In West Virginia West Virginia Center On Budget Policy